TDR Rate Hike Raises Storm on Realty Landscape

- 2nd Mar 2015

- 2806

- 0

The recent drastic hike in both the Transfer of development Rights (TDR) and Floor Space Index (FSI) rates across Maharashtra has raised the hackles of the real estate industry.

The origin of this brewing storm can be traced back to February 2015, when in a sudden move the cash-strapped Maharashtra government decided to drastically hike the rate of premium Floor Space Index (FSI), purchased by developers for redevelopment projects from the government, from approx 30 percent of the property Ready Reckoner rates of 2008 to a whopping 60 percent of the 2015 property ready reckoner rates.

The government defended the move stating that developers could well afford the hike, citing the high prevailing property prices and the need to shore up the state’s revenues, with the estimated INR 7,000 crore inflows to the state’s coffers through this sale. Even before it could recover from this unexpected development, the real estate industry was dealt with a second blow, when the powerful TDR lobby in the state decided to follow suit and hiked TDR prices across the board, citing a need to realign with the state’s TDR policy.

Even before it could recover from this unexpected development, the real estate industry was dealt with a second blow, when the powerful TDR lobby in the state decided to follow suit and hiked TDR prices across the board, citing a need to realign with the state’s TDR policy.

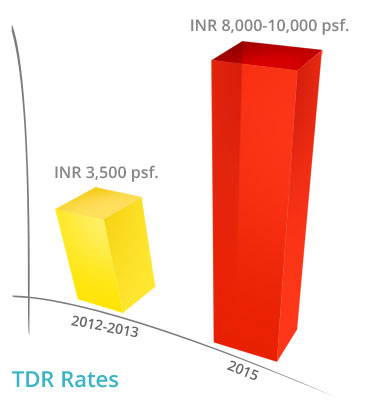

Effectively, this means that the Transfer of Development Rights (TDR) rates will now cost developers anywhere between INR 8,000-10,000 sq.ft, from the erstwhile INR 3,500 psf approx.

Expectedly these twin blows have raised a huge storm in real estate circles, with developers insisting that the new rates would sound the death knell for all redevelopment projects by eating into their profits thereby rendering them financially unviable.

Decoding FSI &TDR:

To fully comprehend the impact of these hikes on ongoing redevelopment projects, it’s important to first understand what TDR & FSI mean from a buyers’ perspective. TDR plays a key role in the redevelopment cycle of a project because it effectively doubles the BUA (Built Up Area), over and above the permitted FSI for that particular plot of land.

Floor Space Index can be defined as the area on a plot which can developed. For example, if the FSI on a development area measuring 15,000 square feet is described as 1, then the built-up area cannot exceed the said 15,000 sq.ft.

How much premium FSI and TDR is required by a particular project is dictated primarily by the size of the project. So the bigger and taller the project, the more TDR & FSI needed. The developer in turn buys the FSI from the government at a cheaper rate (30 percent of the 2008 Ready Reckoner rates until recently) and the TDR from the open market.

For example, when a builder commences a redevelopment project somewhere in the suburbs, he has the option of utilizing the plot’s existing 1FSI and loading an additional 1FSI by purchasing TDR from the open market.

TDR is the assumed space allotted to owners of plots reserved for social causes, like a school, hospital or a public garden in lieu of their right to develop or build on the said plot of land. Owners with such TDR can then sell it in the open market to developers looking for additional FSI who use it to increase the size and height of their projects (by building more floors etc) and booking bigger profits.

Reasons for Developer’s ire:

With ongoing redevelopment projects already caught in a mire of issues including, rising project costs, frequent changes in DCR, need for multiple approvals, debt accruals, litigation, increasing demands from housing societies for more carpet area and an increase in their corpus funds, rampant violations of terms of redevelopment etc, this increase is largely expected to worsen an already bad situation.

In 2014, the Builders Association of India (BAI) estimated a staggering 2,000 redevelopment projects worth an estimated INR 35,000-40,000 crore were stuck in red tape for a variety of reasons. Of this 700 projects were in the dock due to Development Control Rules 33 (7).

Ironically, the list of projects stuck in this logjam also included a long list of the state’s own Slum Rehabilitation Authority (SRA) and Maharashtra Housing and Development Authority (MHADA) housing projects, which traditionally cater to the poor and economically-weaker sections of society.

Developers argue that this drastic increase in rates would have the dual impact of making a majority of redevelopment projects a losing proposition financially and keeping away buyers and investors who would have to bear the additional cost in terms of revised stamp duty and registration estimates.

They further add that this increase is expected to be particularly severe on the many ongoing redevelopment projects in the prime Western suburbs of the city from Bandra-Andheri West, where the existing Ready Reckoner rates are already quite high to begin with.

Presently, developers keen to begin a project in the city’s suburbs, have the option of buying FSI from the government at cheaper rates as compared to the prices quoted by private players.

Another casualty of this government move is likely to be the growing low-cost housing and affordable homes segment. Leading builders opine that if the government wants to encourage the affordable homes segment and adhere to its promise of provided low-cost housing to the weaker sections of society, it needs to revisit its decision to hike the rates.

“With the industry already facing tough times due to subdued buyer sentiments, rising stock of unsold inventory and a tight liquidity situation, no developer will be able to afford to pay the revised rates,” says a leading developer requesting anonymity.

“It is common knowledge in industry circles that a select group of players has a vice-like grip on TDR rates and use it to try and manipulate the market to suit their interests,” he adds. “The government therefore needs to ensure that FSI rates are kept within reasonable limits to ensure a level playing field for everyone.”

Industry players are unanimous in their opinions that if TDR and FSI rates are allowed to escalate unchecked, few builders will be able afford either of them. An undesirable eventuality that could start a chain reaction across the spectrum of real estate projects with disastrous consequences.

Comments

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading other articles