SMART SOCHO: Why buy, when you can rent for less?

- 10th Mar 2015

- 3238

- 0

Should I buy a property or rent one? It’s a conundrum that has dogged the Indian buyer for many a decade and will continue to do so. For a majority of us Indians, buying a home is first a very emotional decision and then a financial one. Roti, kapda aur makaan, as veteran actor Manoj Kumar had once said so eloquently, writes RAJESH KULKARNI.

There is no doubting the fact that in India buying your first home is akin to landing on the moon for most, a life-changing experience and perhaps the biggest moment of their life, yet having said that buying a house often does not make economic sense, more so when you reside in an area where the rentals are far lower than the costs incurred in buying a property. Take the case of Mumbai-based Ranjan Mitra, a senior media professional & single mother with a college-going daughter, who was on the lookout for a decent 2Bhk flat at an up market north Mumbai suburb, since her daughter studied in a college there.

Take the case of Mumbai-based Ranjan Mitra, a senior media professional & single mother with a college-going daughter, who was on the lookout for a decent 2Bhk flat at an up market north Mumbai suburb, since her daughter studied in a college there.

“Most of the ready possession flats I saw carried a hefty price in the region of INR2.5cr-plus,” she reveals. “Under construction projects by reputed developers did offer a staggered payment plan, but did not make sense to me since I wanted to move in immediately.”

Faced with the daunting prospect of taking a huge home loan (to buy a new property) and paying hefty EMI’s for the next two decades, Mitra took an intelligent decision. “I opted to rent a 2Bhk apartment here for about INR 32,000 p.m. It took care of my immediate requirement for a home and the rent was quite affordable for me a salaried professional,” she smiles.

Mitra is right on the money in her assessment. With her available corpus of INR1.5cr, Mitra would have to take a home loan of approx INR1cr to enable her to buy a new 2bhk in a project of her choice. Assuming that the tenure of her loan would be for a period of 20 years, her monthly EMI’s @10.5 percent interest would work out to a whopping INR99,838 p.m. By no means, a small amount for a working professional.

Instead by opting for a rental option, Mitra has limited her monthly outgo to roughly one-third of the amount. A liability which can be easily serviced by the interest accrued on her available corpus of INR1.5cr via a bank fixed deposit, effectively making her home rent-free.

In addition to this she has also managed to save a tidy amount by way of supplementary charges linked with buying property like a hefty part-payment upfront, stamp duty and registration, monthly maintenance (borne by the owner) and travelling expenses since her new place is quite close to both her daughter’s college and her place of work.

When Buying Makes Sense: However this is not to say that buying a property does not make any sense at all. It does albeit in certain specific conditions. For example, when bank interest rates or property prices are down, the costs incurred for buying or renting a property can be fairly close, or when a buyer wants to buy property purely from an investment perspective.

However this is not to say that buying a property does not make any sense at all. It does albeit in certain specific conditions. For example, when bank interest rates or property prices are down, the costs incurred for buying or renting a property can be fairly close, or when a buyer wants to buy property purely from an investment perspective.

It’s a known fact that property (if brought at the right price & location) make for excellent investment vehicles and are known to command a steady premium over time. Moreover, the buyer also has the added advantage of minimizing long term capital gains tax via the accrued indexation benefits.

A self-owned property also gives the owner the chance to earn a second income (or first for many) by opting to rent out additional, unused space (if any). Savvy end users have been known to first buy a sprawling property at a fantastic location via a home loan and then pay the EMI’s by renting it out partially, even as they continue living in the same property with zero liability.

Senior citizens who own property can also go for reverse mortgage if other sources of income have dried up or are inadequate to maintain their normal lifestyle and the rising medical bills that are known to come with advancing age and age-related illnesses.

…But Rent For Now: However in the present context there are several factors that favour renting a property as opposed to buying one. For starters, the property market has been largely stagnant even as property rates have been heading north. Other than the clarification on REIT’s, the much-awaited Budget that was expected to provide relief to the real estate sector has also proved to be damp squib, dealing a double whammy instead by way of an increase in the Service tax (from 12 percent to 14 percent) and a hike in freight rates (of construction material).

However in the present context there are several factors that favour renting a property as opposed to buying one. For starters, the property market has been largely stagnant even as property rates have been heading north. Other than the clarification on REIT’s, the much-awaited Budget that was expected to provide relief to the real estate sector has also proved to be damp squib, dealing a double whammy instead by way of an increase in the Service tax (from 12 percent to 14 percent) and a hike in freight rates (of construction material).

A fact endorsed by Shailesh Dave, a realty analyst with a leading real estate consultancy. “There is presently a huge inventory of unsold flats lying with builders in most urban cities today,” opines Dave.

“Investors are shying away from making bulk purchases because of the stagnant market conditions and dismal returns, while buyers are wary because of the unaffordable prices,” he adds. “In such a scenario, most buyers are opting for rental properties which are much more affordable.”

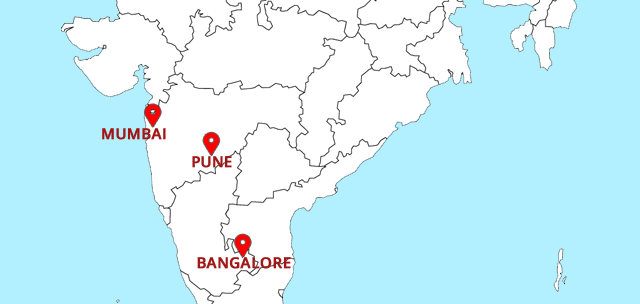

& Top Three Cities for Rentals Are:

Interestingly, according to a recent survey the Top Three cities for rental accommodation in India are: Bengaluru, Mumbai and neighbouring Pune. In Bengaluru for example, suburbs like Chandapura, HSR Layout, Indira Nagar, Electronic City, Marathahalli, Whitefield and the up market Koramangala, are the preferred locations for people searching for rental accommodation. In the Mumbai context, with property rates beyond reach for a majority of buyers, rental accommodation in well-developed areas like Andheri, Bandra, Powai, Kandivali, Borivali and pockets of Navi Mumbai are seeing a spike in demand for rented property. The IT hub of Pune is also witnessing a big increase in rental demand along its IT corridor of Wakad, Baner, Hinjewadi and Kharadi.

In the Mumbai context, with property rates beyond reach for a majority of buyers, rental accommodation in well-developed areas like Andheri, Bandra, Powai, Kandivali, Borivali and pockets of Navi Mumbai are seeing a spike in demand for rented property. The IT hub of Pune is also witnessing a big increase in rental demand along its IT corridor of Wakad, Baner, Hinjewadi and Kharadi.

However, inspite of the huge volume of unsold inventory (an estimated 832 million sq.ft as of December 2014), negative investor and buyer sentiments and a rise in raw material prices, all is not lost for the beleaguered real estate sector in the country.

The recent 25bps cut in Repo rates by the Reserve Bank of India (RBI) has brought a small smile to developers who are optimistic that financial institutions will pass on the benefits to consumers, thereby spurring the demand for homes.

As an avid industry watcher puts it succinctly, “Hopefully if interest rates continue dipping and the economy returns to the growth path soon, the coming Diwali might well be auspicious for the realty industry.”

Comments

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading other articles